what is a provisional tax payment

For years of assessment starting March this will be 31 August if it is a. The provisions which govern the payment of provisional tax are found in Article 42 of the Income Tax Management Act 1994 and in the Payment of Provisional Tax PT Rules 2000.

South African Provisional Tax Guide First Payment Youtube

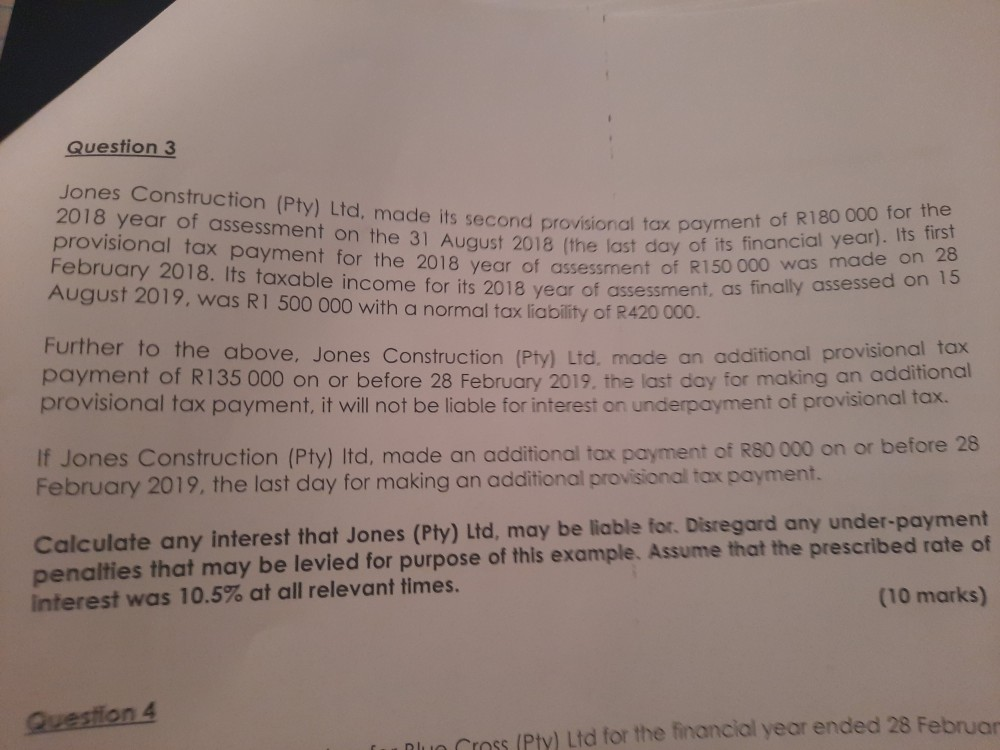

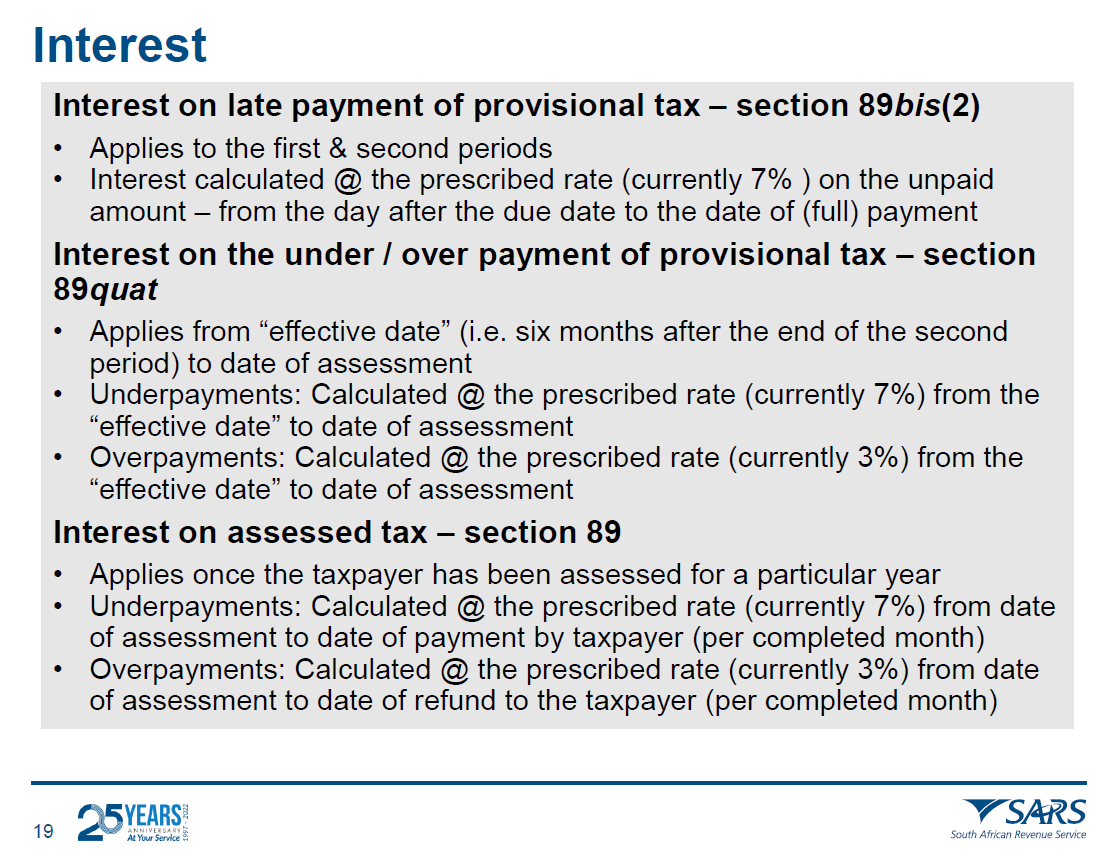

Provisional tax allows the tax liability to be spread over the relevant year of assessment with the taxpayer having two provisional tax periods in which to pay in advance.

. The purpose of the payments is to help you the taxpayer avoid getting too far behind on your taxes. Using your basic amount. It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread over the.

Provisional taxpayers calculate their provisional tax. Your provisional income is a combination. This means that they are not employed but get some form of regular income.

Provisional tax is not a separate tax. A provisional taxpayer is a person whose income accrues through other means other than salary. Paying tax in your first year in business Your first year in business is not tax free.

Provisional income is a tool used by the IRS to determine whether youll pay federal income tax on part of your Social Security benefits. Provisional tax is not a. What is provisional tax.

Provisional tax is tax you pay in advance. The first provisional tax payment must be made within six months of the start of the year of assessment. To qualify for provisional tax as of the financial.

Or The basic amount is the taxable income of the latest assessment not. It is a method of paying the income tax liability in advance to ensure that the taxpayer does not remain with a large tax. If you make voluntary payments before your tax is due you may get an early payment discount.

Self Employed people rental property owners and people who. Provisional tax is a system that ensures those who earn income from sources other than an employer pay tax during the tax year. The aim is to help.

It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread over the relevant year of. How To Calculate Provisional Tax For Companies. HOW PROVISIONAL TAX IS CALCULATED First payment Provisional tax is calculated.

Compute the cash provisional payment in a month using normal SSI income counting rules and payment calculation methods except no state supplementation is included in. Provisional tax is income tax you pay in instalments during the year. Provisional tax is the IRDs tool to prevent these sorts of tax bills.

Provisional tax is not a separate tax from income tax. According to the information of the Inland Revenue Department Provisional Tax is a government requirement which is calculated based on the taxpayers income in the previous. Provisional tax is not a separate tax.

They calculate it by taking their total taxable income for the year and dividing it by four. The first provisional payment is 50 of the liability and the second is the total liability less the first provisional tax payment. Not EVERYONE pays provisional tax.

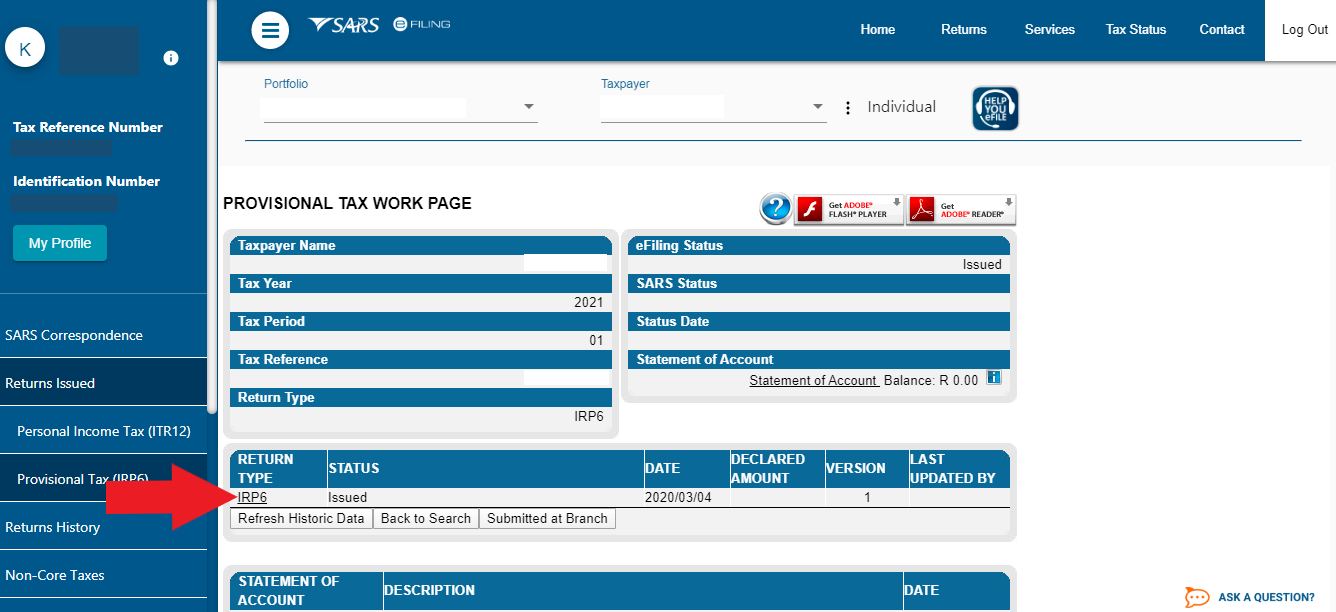

Provisional taxpayers are required to submit two provisional tax returns during the tax year and make the necessary payment to SARS if a payment is due on the return. Provisional taxpayers are required to pay income tax on. This is equal to your provisional tax.

Everyone pays income tax if they earn income.

How Aim Compares To The Other Provisional Tax Options

Provisional Tax Finite Solutions

What Is A Provisional Taxpayer Tax 101 Youtube

Provisional Tax Who Is It For And When Should It Be Paid

Extension Of The April Provisional Tax Payment Deadline Kpmg Malta

Tax Accountant Tax Rates Income Tax Tax Facts National Accountants

Grade 12 Companies Ledger Accounts Lesson 2 Youtube

How To Calculate Provisional Tax Payments Guide And Calculator

Dispute Resolution Process And Provisional Tax Ppt Download

Provisional Tax Due Shortly Pphc Global

Provisional Income Tax Due 26 February Do S And Don Ts For Companies Ldp

Sa Revenue Service On Twitter An Example Of Provisional Tax Estimates Based On The Applicable Provisional Tax Payment Periods Yourtaxmatter Https T Co Uuz09vltoa Twitter

Provisional Tax Payments That Suit Business Cashflow Tax Management Nz

Payment Of The 2nd Installment Of 2021 Provisional Tax M Target

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

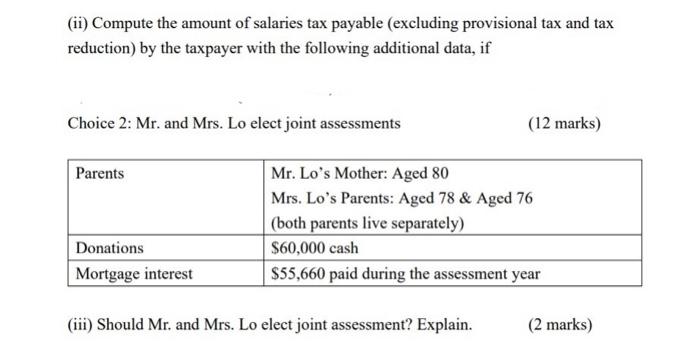

Ii Compute The Amount Of Salaries Tax Payable Chegg Com